Do you often reach the end of your day and feel like, regardless of how busy you’ve been, you still don’t feel productive?

It’s all too easy to begin our day in our emails and allow all the interruptions of ‘urgent messages’ to run our entire day. These digital distractions can seriously affect our productivity. The constant notifications and easy access to social media and other websites can lead to procrastination, reduced focus, and decreased efficiency. It’s important to set boundaries and limit distractions in order to be more productive.

Asana, the project management tool, often talks about productivity on their website and in one article they share how digital distractions can be the arch-nemesis of deep work (focussed, uninterrupted work).

According to them, distraction—especially of the digital variety—is more common than ever in today’s fast-paced work environment. At a time when 80% of knowledge workers report working with their inbox open and nearly three in four employees feel pressure to multitask every day, avoiding digital distractions can seem nearly impossible.

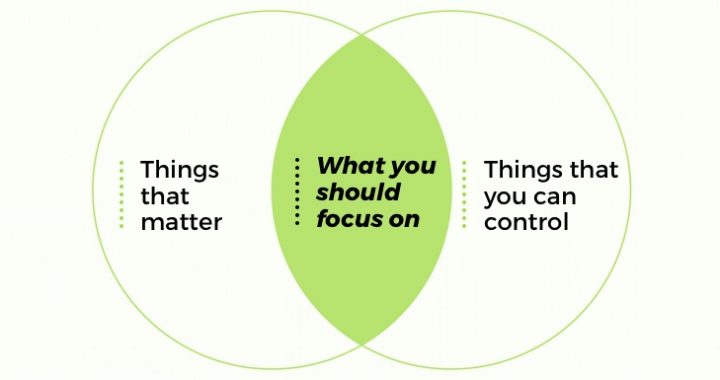

However, minimising distractions is still doable with a few simple strategies:

Turn off notifications.

Sounds, banners, and notifications flashing across your screen have a negative impact on focus and can quickly jolt you out of deep work. When you’re trying to focus, use Do Not Disturb mode or snooze notifications for your phone and any communication apps you use. Or to really disconnect, close your email and messaging apps completely. Remember that you can always check notifications during your next focus break.

Make depth your default.

Instead of living in a distracted state and wrangling your brain into focus mode to complete tasks, schedule focus breaks—times when you allow yourself to take a break and give in completely to distractions. You can use this strategy during your workday or in your personal life. For example, you could schedule a focus break after work when you’re allowed to browse the internet and scroll through social media—then turn your undivided attention to cooking dinner, watching a movie, or talking with loved ones.

Choose your tools wisely.

According to Asana’s research, the average knowledge worker switches between 10 apps 25 times per day to do their work—and employees who switch between apps are also more likely to struggle with effectively prioritising their work. But just because a tool exists doesn’t mean you have to use it.

Lighten your tech stack as much as possible!

And, let’s not forget that one of the reasons all these interruptions exist is because of FOMO. We need to decide if we will let the fear of missing out run our day and leach our productivity, or if we will be ready to reduce digital distractions.

Digital distractions drain our creativity, our energy and our focus and the key to being more productive lies in managing them more wisely.